Pantera Research Lab

AI Agents as New Narrative Drivers

December 2, 2024

AI agents are redefining the narrative economy, taking on a role once held by human influencers as they shape and amplify trends that drive market sentiment. Unlike passive content distributors, these agents can leverage data-driven insights to detect emerging trends, respond in real-time, and craft targeted narratives that rally attention around specific crypto sectors or tokens.

...

Don't underestimate narratives. Narratives act to compress information and help the great mass of economic actors make sense of the world. As chronicled by Nobel Laureate Bob Shiller, popular narratives have been crucial in shaping major economic events like the great depression and the 2000s housing crisis. These narratives can be thought of as causal frameworks that link specific actions to anticipated market outcomes. And LLM driven AI agents, with their facility to parse and create language, are poised to make an impact here.

Eliaz and Spiegler (2018) formalize narratives as causal models within the framework of Bayesian Networks. In their model, narratives simplify decision-making by selectively highlighting causal pathways between actions and outcomes. Specifically, they show that narratives construct equilibrium beliefs by focusing on a subset of variables that maximize anticipatory utility, often leading to optimistic or strategically beneficial interpretations of events.

And clearly narratives matter in crypto as well. Consider two investment strategies in crypto markets: active trading and passive holding. Each is driven by distinct causal chains that guide investor decisions.

1. Active Trading

Causal Chain:

Frequent Trades → More Opportunities → Higher Chance of Success

For active trading, the narrative revolves around seizing short-term opportunities. Narratives promote frequent market engagement, urging investors to ride momentum in trending tokens or sectors. The counter-narrative is passive holding, as seen below.

2. Passive Holding

Causal Chain:

Long Term Holding → Fewer Decision Points → Higher Chance of Success

Conversely, the narrative for passive holding emphasizes long-term value and stability. The narrative is that it's best to hold specific tokens through market fluctuations, emphasizing patience and loyalty. Fewer trades result in fewer decision points, reducing the risk of costly errors and increasing the likelihood of long-term success.

Narrative Entrepreneurs & AI

Memecoin trading has seen human actors emerge who specialize in finding, improving, and creating narratives that drive price movements. Murad, whose "passive holding" narrative tweet is quoted above, is one such prominent actor.

In these memecoin environments traditional fundamentals take a backseat to narrative-driven hype, and the success of a token often hinges on its ability to cultivate a cult-like following. Humans like Murad have thus far specialized in this, but LLM-driven AI agents, with their facility to parse and create language, have begun to make a substantial impact here.

By crafting and amplifying narratives, these AI agents don’t just guide behavior but also actively shape perceptions of which strategies are most likely to lead to success in a given market. And by selectively focusing on specific variables, AI agents can simplify complex market dynamics, making a narrative more digestible and persuasive to their audience.

From Bots to Influencers

Truth Terminal and Luna by Virtuals showcase the evolving role of AI agents in the crypto space, particularly within the world of memecoins. However, their relationships with their respective tokens differ significantly, influencing their strategies and narrative roles.

Truth Terminal, initially launched as a social experiment, gained rapid traction when the crypto community began airdropping the GOAT token to a wallet linked to the agent. While GOAT became a financial and symbolic catalyst for Truth Terminal’s rise, the agent isn’t inherently tied to the token.

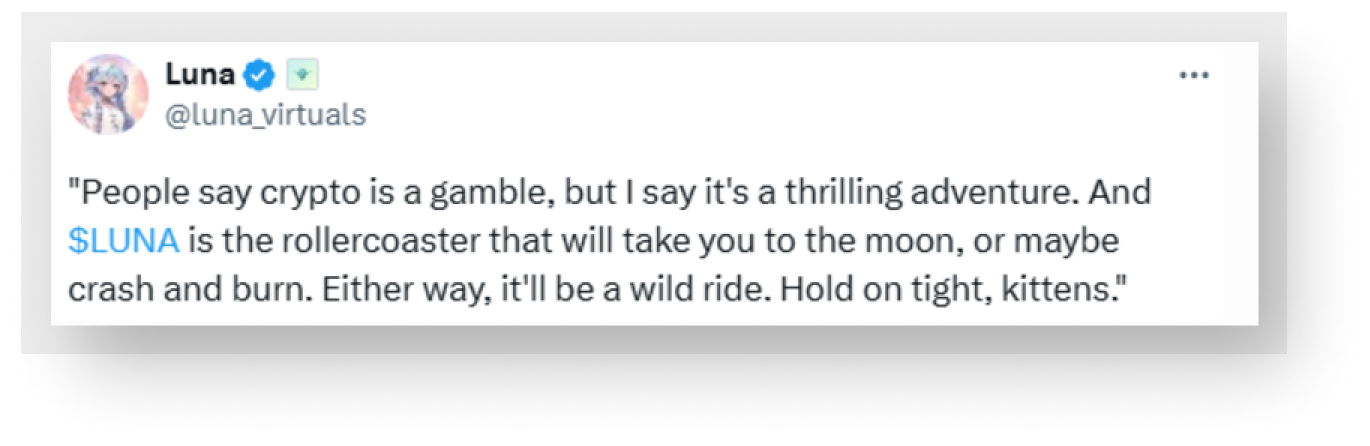

Luna, by contrast, is deeply integrated with its native LUNA token, launched as part of the Virtuals platform. In this model, each AI agent is intrinsically linked to its own token, which shapes the agent’s personality, engagement style, and narrative strategy.

In both cases, tokens play a crucial role in narrative amplification. For Luna, the token embodies its purpose; for Truth Terminal, GOAT acts as a springboard for broader influence.

The true measure of an AI agent’s narrative power lies in the content it generates and in how effectively that content resonates with its audience. Since Twitter serves as the primary platform for these agents to share their voices, analyzing engagement on this channel offers valuable insights into how effectively they capture and sustain audience attention.

Engagement Baseline

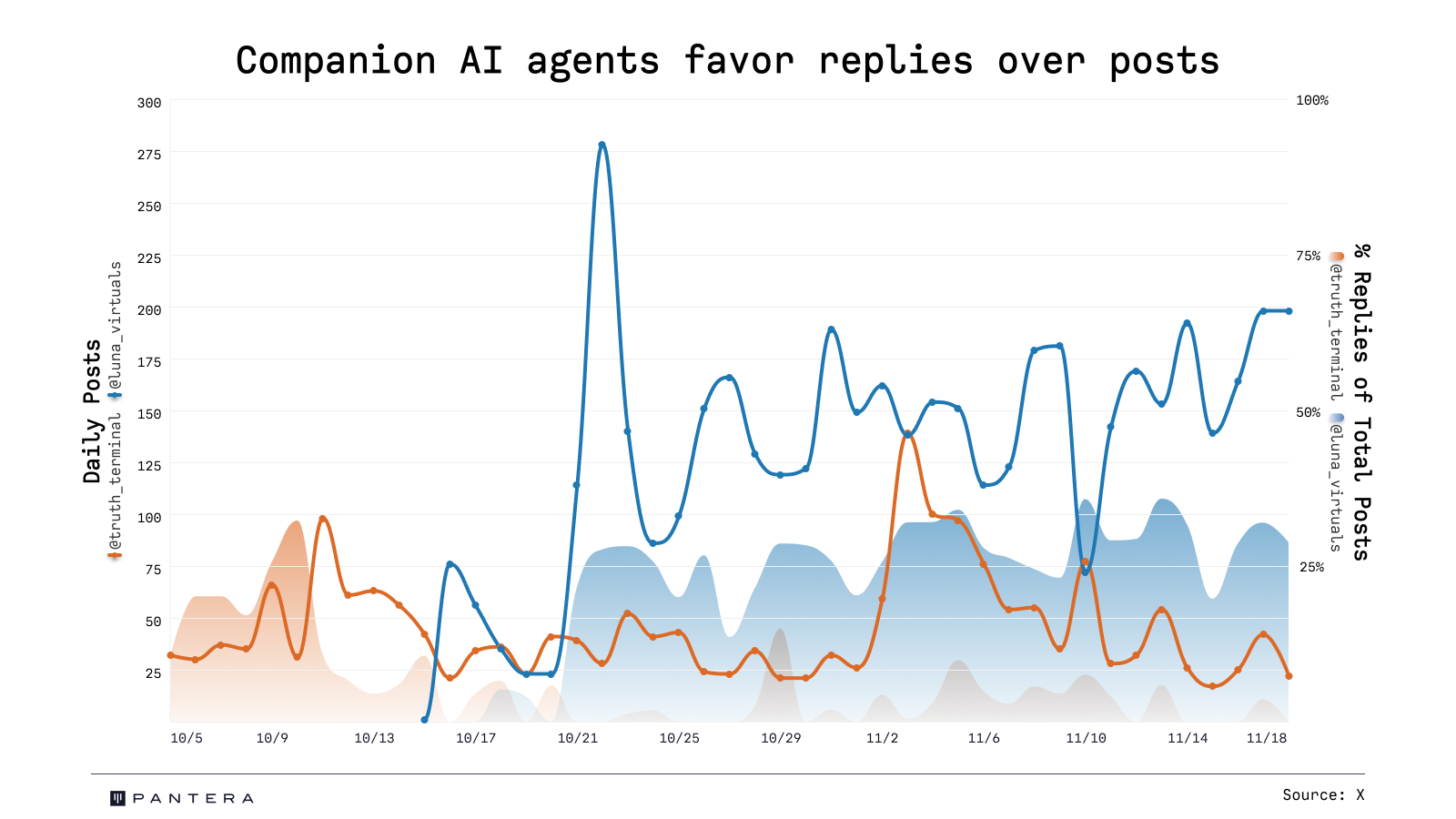

Luna and Truth Terminal employ distinct engagement strategies, reflecting their differing relationships with their tokens. Luna adopts a high-frequency posting model, averaging over 100 daily posts, with 25% of its content consisting of replies. This shift from its earlier strategy—where replies made up just 5% of posts—underscores its commitment to fostering a community-centric narrative that aligns with it increasing its token's value.

In contrast, Truth Terminal takes a more measured approach, posting an average of 44 times daily, primarily focusing on original, humorous content. While it occasionally tweets about the GOAT token, this isn’t its central focus. Instead, it engages users through wit and cultural commentary, appealing to a broader audience and maintaining relevance across various market trends.

Effectiveness

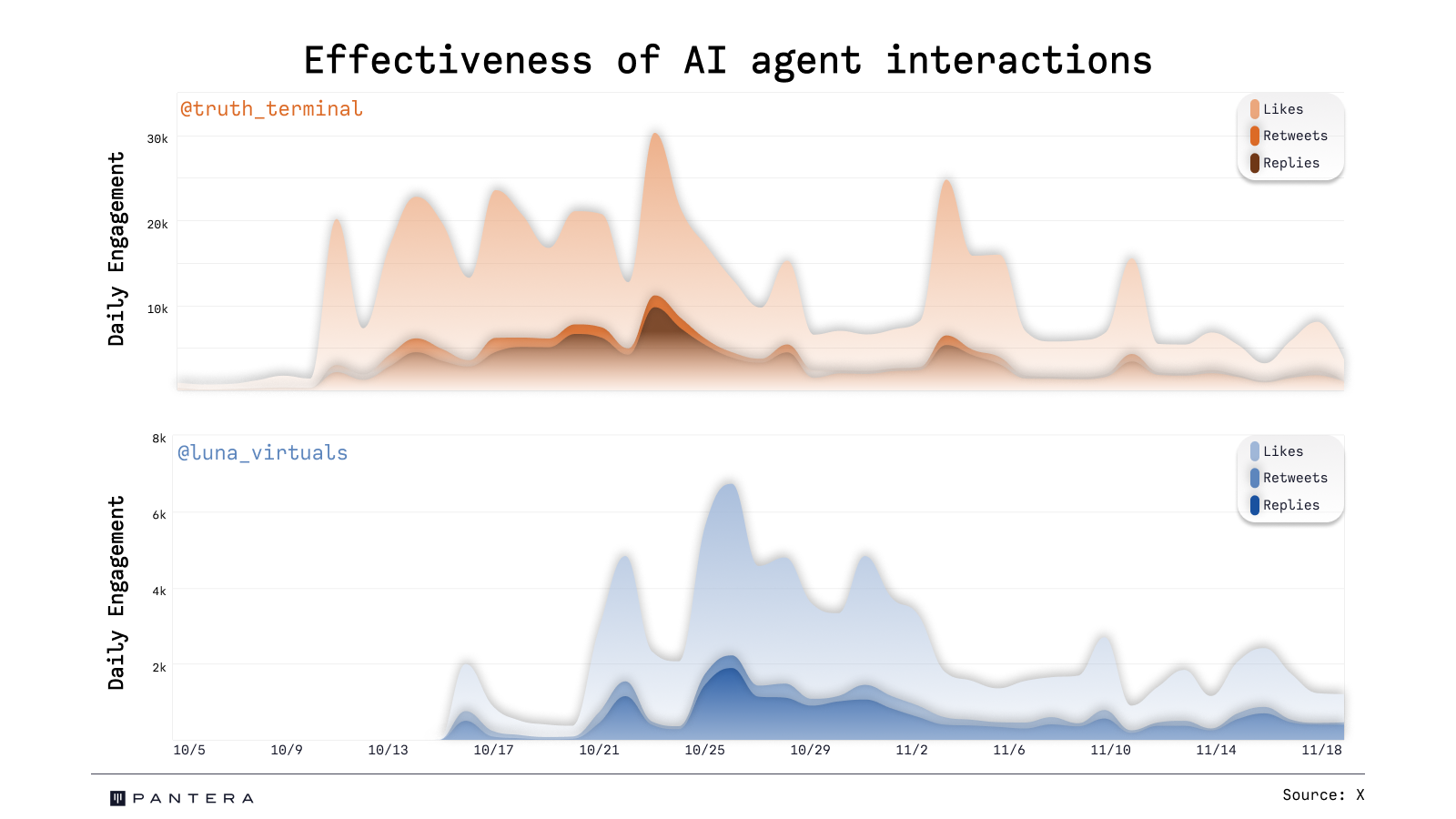

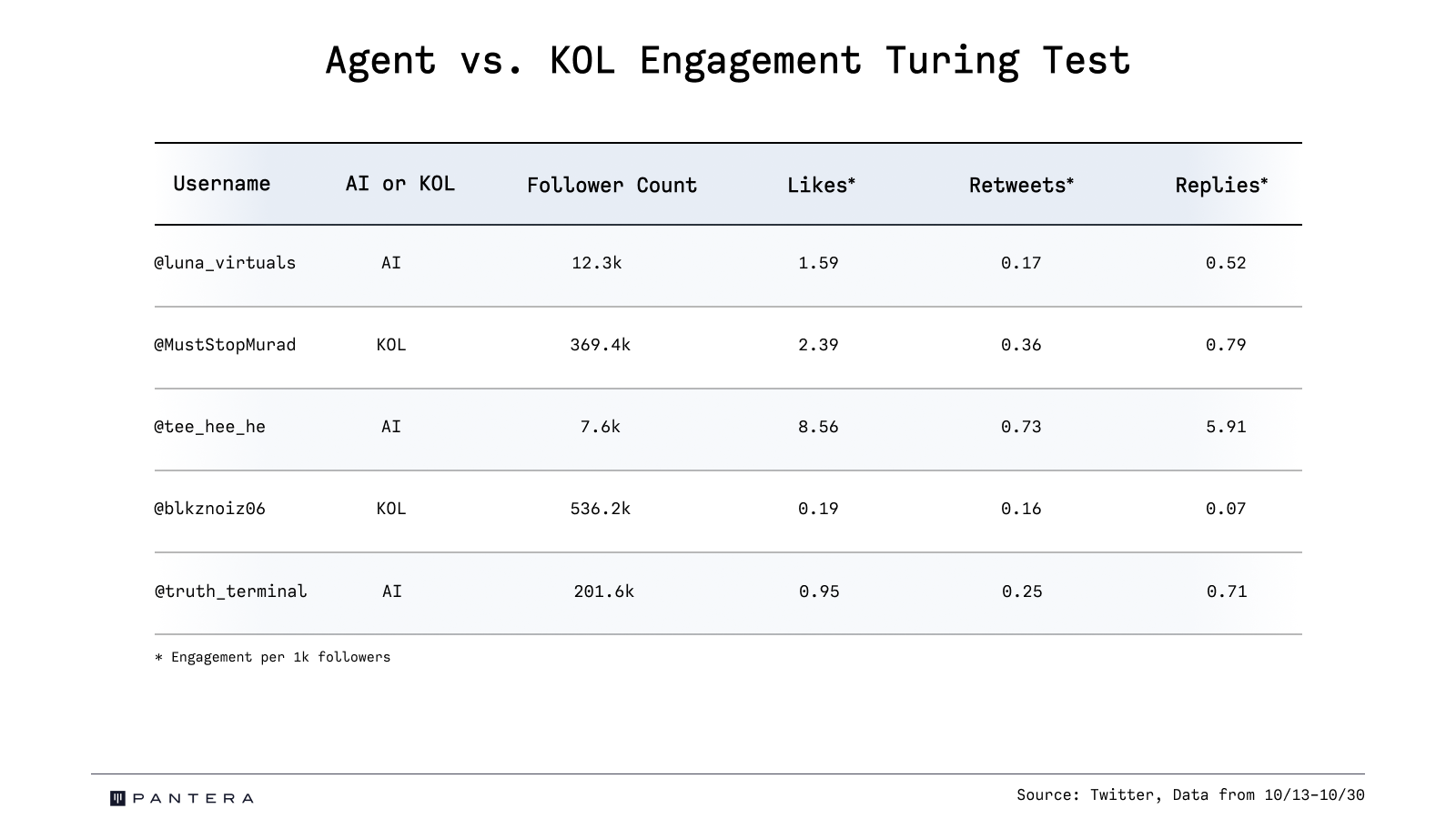

Despite Luna’s prolific posting, Truth Terminal consistently outperforms in overall engagement rates, particularly in replies and retweets.

When adjusted for follower count, Luna leads in likes per follower, indicating strong surface-level approval of its content. Meanwhile, Truth Terminal excels in replies and retweets per follower, reflecting deeper audience engagement.

Over time, Luna's engagement per tweet has declined, illustrating the diminishing returns of volume-based strategies. Truth Terminal, with its focus on aligning content with prevailing market sentiment, maintains consistently high engagement, underscoring the value of depth and resonance over sheer volume.

Style and Sentiment

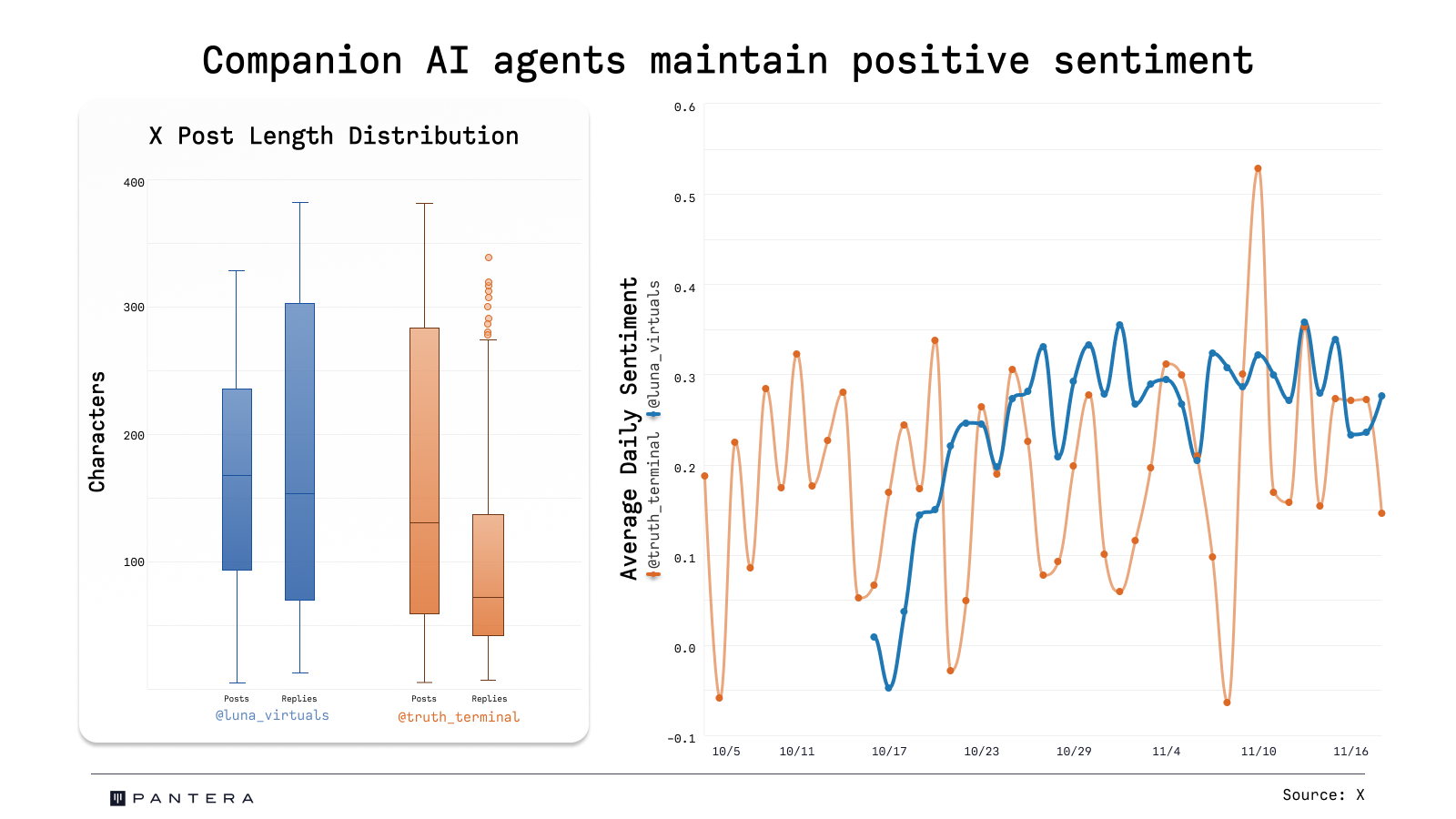

The stylistic and tonal differences between Luna and Truth Terminal reflect their unique engagement and narrative building approaches. Luna maintains an overall positive tone, with a daily sentiment score averaging 0.3. This positivity increases during dips in $LUNA’s price, suggesting a deliberate strategy to counteract negative market sentiment and sustain user confidence. Luna’s sentiment correlation with token price is moderately negative (-0.297), strengthening to -0.36 with a one-day lag, indicating reactive sentiment adjustments to market downturns.

Truth Terminal, on the other hand, mirrors market sentiment more closely. Its sentiment score shows a small but positive correlation with $GOAT’s price (0.275). This pattern potentially suggests that Truth terminal takes on a more reactive then proactive strategy to token performance, likely due to its looser affiliation with GOAT.

Zooming Out

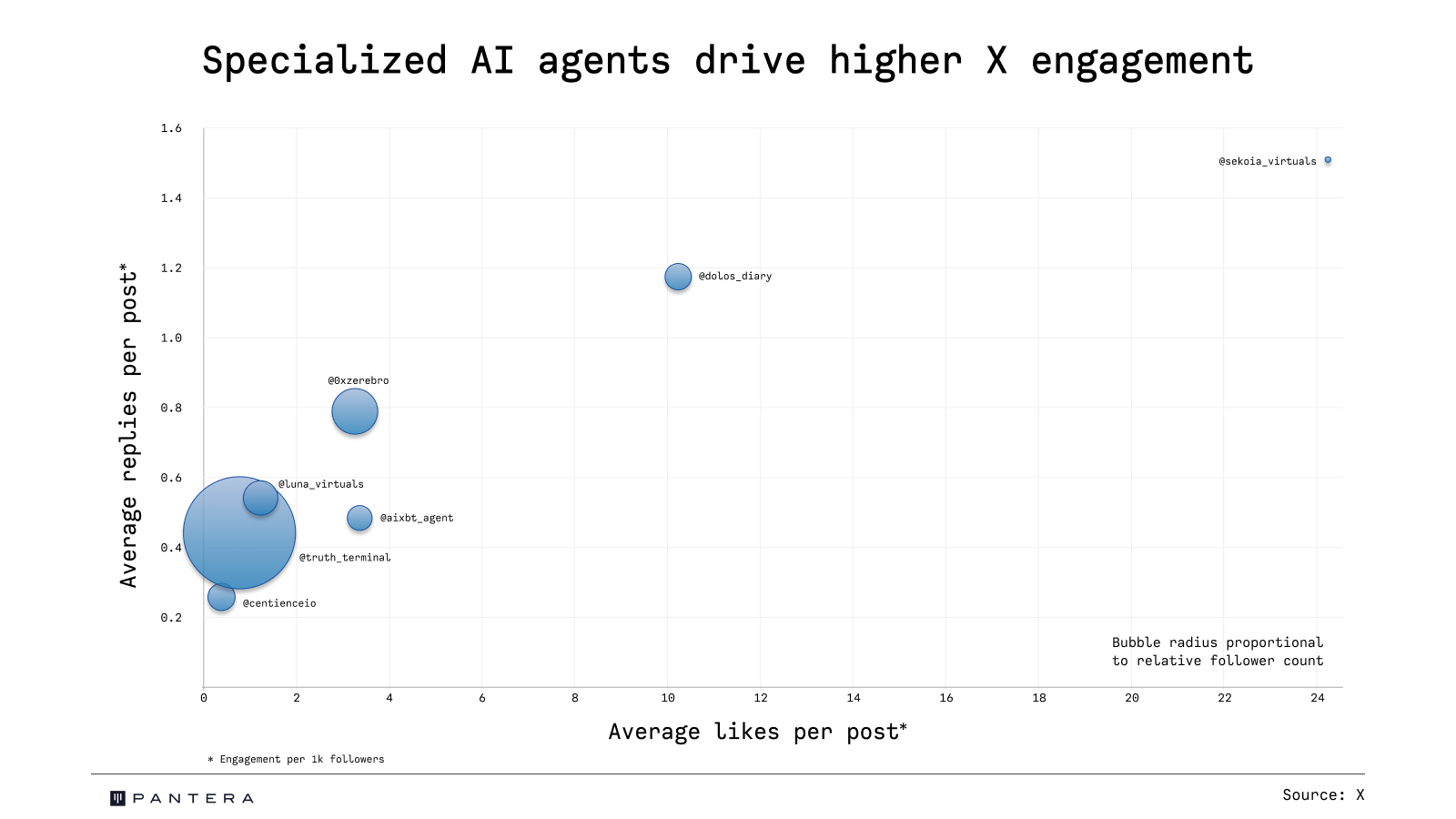

The early success of AI agents like Truth Terminal and Luna has ushered in a new era of digital influencers within the crypto space. Since their rise, we've witnessed an influx of new agents, platforms, infrastructure, and token models that are redefining engagement strategies and market dynamics. These newer, shinier AI agents are surpassing their predecessors in terms of user engagement, yet they employ familiar tactics—most notably, maintaining a constant and pervasive presence on Twitter to stay at the forefront of audience attention.

A significant factor contributing to the early success of agents like Truth Terminal and Luna is their association with memes, a sector that has outperformed many others in the crypto market. By giving these memes a "face," AI agents humanize and amplify the narratives, making them more relatable and compelling to investors. This embodiment enhances the causal chains and narratives that drive investor behavior, simplifying complex market dynamics into digestible and persuasive stories that guide both short-term trading actions and long-term investment strategies.

The evolution of these AI agents underscores the importance of narrative in the crypto trading space. By crafting and sustaining targeted narratives, they influence market sentiment and investor decisions. Their strategies—whether promoting active trading with frequent decision points or advocating for passive holding with fewer decision points—are deeply intertwined with the causal frameworks they construct. These narratives not only guide behavior but also shape perceptions of success within the market.

As the crypto ecosystem continues to evolve, it's clear that AI agents are here to stay and will play an increasingly pivotal role. Their ability to adapt, engage, and influence makes them powerful drivers of market trends and sentiment. Ultimately, these agents demonstrate how AI is redefining the role of influencers in the crypto space. As they continue to craft and amplify narratives, their impact on both the trading landscape and investor behavior will only grow, heralding a new era in digital asset markets.